)

Credit cards have been around since the 1920s - issued by stores to let loyal customers spend easily. The first Diner's Club cards arrived in 1950 - the original "universal" credit cards.

Since then we've seen the creation of corporate credit cards, debit and deferred debit cards, magnetic strips, security strips, and even virtual credit cards.

Credit, and the absence of cash, have become essential to the modern economy. And businesses everywhere rely on credit to pay and get paid.

In the first half of this article, we’ll look at some interesting facts around credit card adoption and use in the United Kingdom, the United States, and Europe.

Then, we’ll look closely at statistics for credit card fraud in those markets, and some reasons why rates may be different in each. Mitigating fraud is crucial to a functioning credit system, and the differences in these markets is fascinating.

Credit card statistics

Let’s begin by looking at several very interesting data points around credit card use - both personal and professional. We'll begin with just how widespread the use of credit cards actually is.

Card ownership

There are 1.06 billion credit cards in use in America, and 2.8 billion credit cards in worldwide. (Shift Processing)

Americans have an average of four credit cards. (Experian)

In the EU, the number of cards carried per inhabitant ranges from 0.8 to 3.9. (European Central Bank)

Luxembourg leads Europe for the number of cards carried, but this includes the portion of cards issued to cardholders not living in Luxembourg. (European Central Bank)

In the UK there were 32.3 million people with a credit or charge card in 2016, about six in ten adults. (The UK Cards Association)

There were 51.1 million UK debit card holders in 2016, more than nine in ten adults (96%). (The UK Cards Association)

Total spending on all debit and credit cards in the UK reached £800 billion in 2018, with 20.4 billion transactions made during the year. (UK Finance)

Card payments made up 78.4% of all retail sales in the UK by the end of Q1, 2017. (Merchant Savvy)

There were 368.92 billion card transactions worldwide in 2018. (CardRates.com)

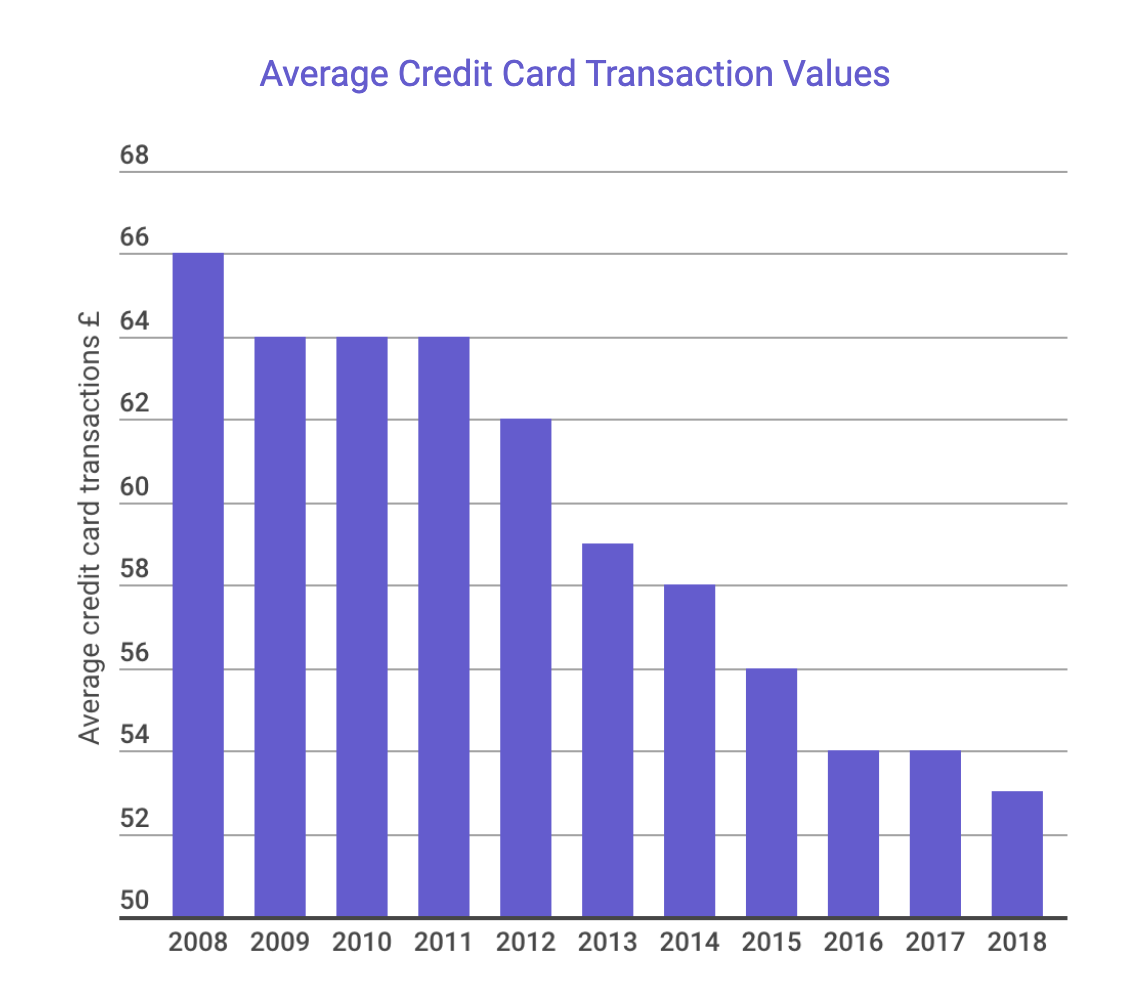

The average value per card payment in the UK is decreasing quickly:

Image source: Merchant Savvy

This is most likely due to the rise of contactless payments. These have £30 spending limits and these small transactions have replaced what would previously have been cash payments.

As credit card use grows, so too must credit card debt. Businesses and individuals take small loans from their card providers in the hopes of paying these back before the interest kicks in.

So how significant is credit card debt around the world?

Credit card debt

U.S. credit card debt surpassed $1 trillion in 2017, and was at $868 billion as of August 2019. (Reuters)

However, 2020 was the first year in which average credit card debt in the U.S. decreased - down 14% from 2019. (Experian)

Alaskans have the highest average credit card debt among states, followed by Connecticut and New Jersey. (Experian)

Iowa had the lowest average amount of credit card debt in 2020, followed by Wisconsin and Mississippi. (Experian)

Together, Britons have £72.1 billion in credit card debt. (The Fool)

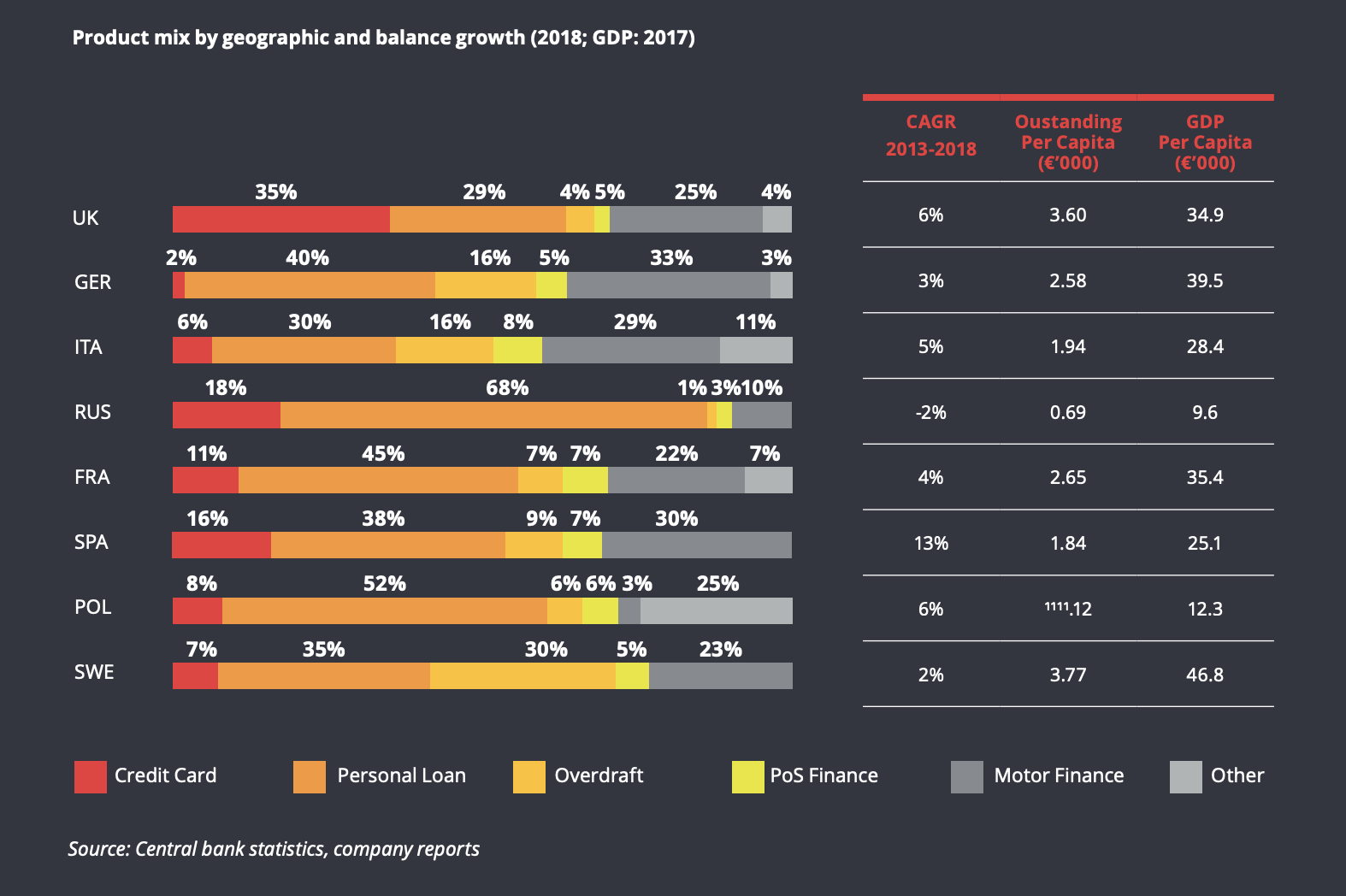

German customers are known for being debt-averse, while British and Turkish people (among others) often carry large amounts of revolving debt. (Deloitte)

Image source: Deloitte

New technologies

As we’ll see shortly when we look at fraud, new technology can have a large impact on the way that people pay.

There were around 3 billion contactless transactions made in the UK in 2016. This equated to £25 billion in spending, most of which, £22 billion, was via contactless debit. (The UK Cards Association)

Thanks to contactless payments, card-based transactions overtook cash in 2017 as the primary payment method in the UK. (Merchant Savvy)

Apple Pay has more than 383 million users worldwide. (Statista)

Until 2018, the Starbucks app was the most popular payment app in the US, despite only being available for use in the chain’s coffee shops. It has now been overtaken by Apple Pay. (eMarketer)

Let's turn now to a specific form of credit card relied on heavily around the world.

Impact of Covid-19

The Covid-19 pandemic form 2020 onwards made society more hygiene-aware, and seems to have affected people's preferences over cash versus card.

The volume of cash being used in the UK dropped by up to 60% in 2020. (Upgradedpoints.com)

In the US, 28% of people stopped using cash altogether. (FRBSF)

Online shopping made up 28% of sales in the UK in 2020, up from 19% the year before. (Upgradedpoints.com)

These three statistics indicate that credit card use almost certainly increased during the pandemic, especially when compared with cash. Contactless payments will also doubtless have increased, with some countries mandating these.

And of course, business travel (and all travel) plummeted. Which will naturally have reduced overall credit card spending for work expenses.

Read more about Covid's impact on business travel.

Business credit cards

Businesses from small to enterprise rely on credit cards both as a line of credit, but more importantly to make company purchases. While we don’t think traditional company credit cards are the best option for most, it’s clear that the majority of companies still see them as an essential tool.

About 67% of small businesses have a company credit card, but only 24% say that it’s the primary method of business spending. (Forbes)

Though relatively few in number, small business credit cards account for roughly 1 in every 6 dollars spent on general purpose cards in the US.

Only 29% of American small-business owners who collect credit card rewards actually use these to pay a business expense. (Forbes)

The average US business credit card interest rate is 19.71%. For travel rewards cards, that rate is 20.56%. (The Balance)

There are 500,000 business credit cards in use in the UK. (Finder.com)

SMEs make up 99% of British businesses and 13% of those use credit cards. (Finder.com)

Credit card fraud statistics

Let's turn now to a significant issue for both businesses and individuals worldwide: credit card fraud. According to Merchant Savvy, global payments fraud has tripled from 2011 to 2020, rising from $9.84 billion to $32.39 billion.

Using statistics, we'll try to understand the nature of this issue in Europe, the UK, and the US. But first, we need to set out the kinds of credit card fraud people can encounter.

Types of credit card fraud

In the following data points we’ll use a few terms repeatedly. Rather than repeat their meaning every time, here are the key definitions for different types of credit card fraud:

Card-not-present (CNP) fraud: These are instances of fraud where a physical card is not required. This usually means online payments. It is also known as “remote purchase” fraud.

Online fraud: One kind of CNP fraud involving payments made online.

Mail and telephone order fraud: Other instances of CNP fraud involving stolen credit card details used over the phone or by mail.

Card-present fraud: This is an umbrella term for the types of fraud requiring a physical card.

Counterfeit card fraud: Here, fraudsters copy your card details through its magnetic strip (often done using a skimmer) and then recreate your credit card. This is card-present fraud because it requires your physical card.

Lost and stolen card fraud: This is where your physical card is either lost or stolen and used by others to make purchases.

Card ID theft: In this instance, your card details become known to a criminal who then uses them to create a new account in your name.

ATM fraud: This usually includes instances where a card was charged but cash was not delivered, or where a physical card was skimmed (leading to counterfeit card fraud).

Point-of-sale (POS) fraud: Also commonly called retail fraud. This generally refers to an employee defrauding their employer at the point of sale.

There’s one more important term that you’re about to see a lot:

SEPA: The Single European Payments Area is an agreement that standardises bank transfers between 36 countries. These are the 28 EU-member states, plus Iceland, Liechtenstein, Norway, Switzerland, Andorra, Monaco, San Marino, and Vatican City. It governs payments and transfers in euros, specifically.

Now with those definitions out of the way, let’s get into the statistics.

UK fraud statistics

As a major financial centre with a huge banking sector, credit card fraud in the United Kingdom is a hugely important topic. As we’ll see, fraud is present in even the most rigorous countries, and seems to increase along with the size of the economy.

In 2018, total fraud losses on UK-issued cards amounted to £671.4 million, up 19% from 2017. (UK Finance)

Fraud losses as a proportion of total spend volume also increased, moving from 7p per £100 spent to 8.4p per £100 in 2018. This is still lower than than the 2008 rate of 12.4p per £100. (UK Finance)

Remote purchase fraud rose to £506.4 million in 2018 (up 25% from 2017), including an estimated £265.1 million in online fraud against UK retailers (up 29%). (UK Finance)

Overall, 78% of all remote purchase fraud was committed online. (UK Finance)

Mail and telephone order fraud against UK retailers also increased by 14%. (UK Finance)

Broken down by channel, card fraud losses are composed of: ATM fraud (3%), POS fraud (20%), and CNP fraud at 77%. (Nets.eu)

E-commerce fraud still represents 50% of total UK card fraud losses at £310.2 million. (Nets.eu)

UK Finance puts the e-commerce fraud amount even higher: £393.4 million, or 59% of all card fraud.

Counterfeit card fraud cost £16.3 million in 2018, a decrease of 33% from 2017 and 90% below its peak in 2008. (UK Finance) The sizable reduction between 2008 and today is likely the result of chips in cards.

Card ID theft increased 59% to hit £47.3 million in 2018. (UK Finance)

Note: Most card ID theft is a result of “data harvesting” by criminals. Common tactics include phishing emails as well as physically stealing mail from external mailboxes.

Fraud in SEPA region overall

As a reminder, SEPA states include all EU countries (including the UK), the Nordics, and several other key financial states like Switzerland, Monaco, and Liechtenstein. These countries will also have their own specific rules - especially where the chief currency is not the euro.

The total value of fraud for cards issued within SEPA was €1.8 billion in 2016. (European Central Bank)

73% of this value comes from CNP payments, 19% from transactions at point-of-sale (POS) terminals, and 8% from transactions at automated teller machines (ATMs). (European Central Bank) It’s worth noting that CNP fraud is the only one of these categories to increase. Meanwhile card-present fraud decreased by 9.5%.

Portugal is the only SEPA country with higher point-of-sale fraud than card-not-present. (European Central Bank)

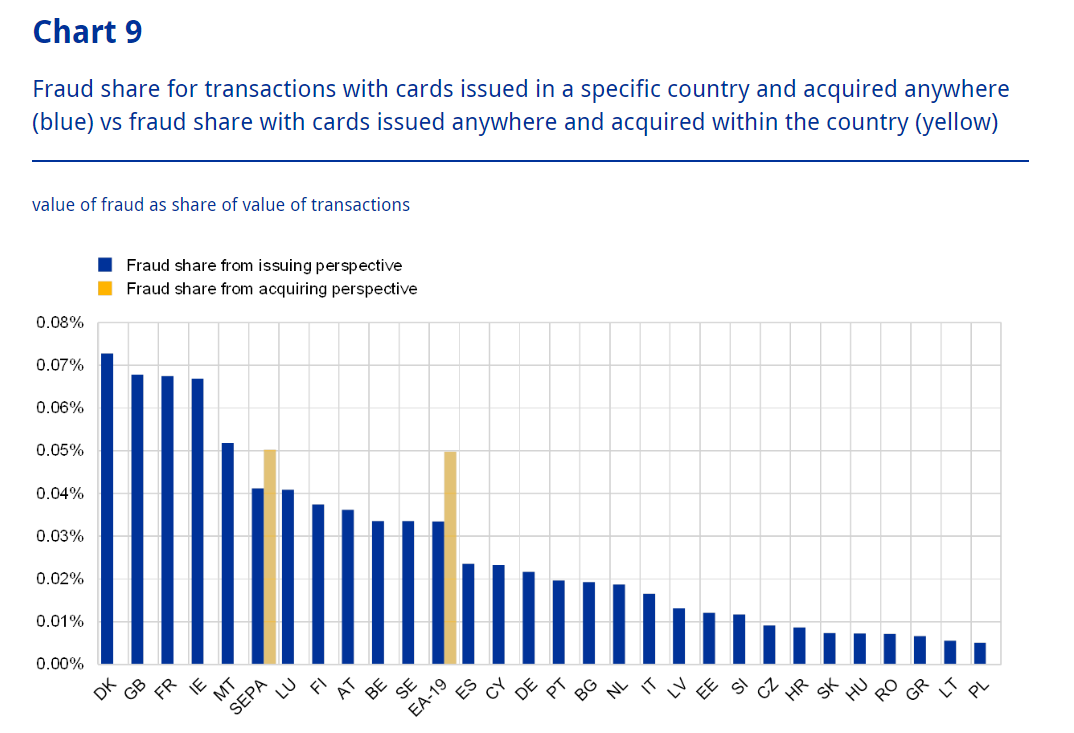

The level of fraud as a portion of transaction value ranges from 0.005% for cards issued in Poland to 0.073 % for cards issued in Denmark in terms of value, and from 0.002% in Poland to 0.043% for cards issued in France in terms of volume. (European Central Bank)

Image source: European Central Bank

In general, countries with significant card markets (high volumes and values of card transactions per inhabitant - notably Great Britain and France) also experience high levels of card fraud. (European Central Bank)

Data from a different report also found high levels of fraud in the UK and France, but lower levels in the Nordics (compared with the ECB report above).

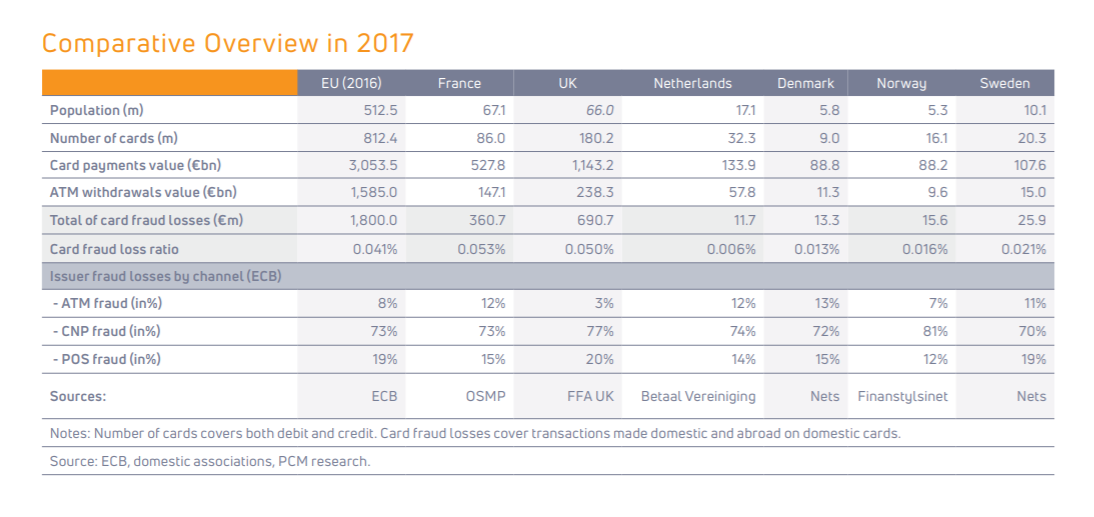

The Netherlands (0.006%), Denmark (0.013%) and Norway (0.016%) have the lowest ratio of fraud versus legitimate purchases, compared with 0.53% in France and 0.5% in the UK. (Nets.eu)

Image source: Nets.eu

As the Nets.eu report states:

“The Netherlands and the Nordic countries are examples of fraud control best practices in Europe thanks to the managed fraud and risk prevention services of their pan-European processors which cover cross-border fraud prevention expertise. In contrast, the UK and France continued to experience higher card fraud losses, mainly from CNP fraud on internet purchases, lost and stolen card fraud, and cross-border fraud losses on domestic cards used abroad.”

The share of fraud is much higher for credit cards and delayed debit cards than debit cards. (European Central Bank) In other words, fraudsters prefer to target credit.

Payments made across borders but within SEPA make up 43% of total fraud, followed by domestic fraud (35%) and cross-border fraud outside SEPA (22%). (European Central Bank)

The overall decline in most types of card-present fraud is likely the result of EMV chips having become the norm across the West. This has made it far more difficult for skimming readers to use stolen credit card details.

Similarly, we expect to see a drastic reduction in CNP fraud in the coming years, especially in SEPA. Recent updates to the PSD2 regulations, including the roll-out of 3D Secure payments make it far more difficult to commit fraudulent online payments.

Learn more about PSD2 and 3D-S, and how they affect online payments for businesses.

These are the statistics and trends for the SEPA region as a whole. But it’s also worth diving deeper into a few specific markets.

Credit fraud in France

France has its own card system known as CB (cartes bancaires). This means it has some different rules governing payments, on top of the standard rules for SEPA countries.

It’s possible that these rules make committing credit card fraud within France far more difficult. But, as with the UK, rates in France are still sizable.

Domestic fraud losses on French cards have plateaued at 0.032%. (Nets.eu)

But the fraud rate on French cards used abroad in non-SEPA countries was 16 times higher than on domestic transactions in 2017, while for foreign cards used in France the rate was 12.1 times higher. (Nets.eu)

Theft of card details accounted for 66.1% of total domestic card fraud losses in France. (Nets.eu)

The main methods of compromise responsible for fraud losses are lost and stolen fraud (16.3%) and CNP fraud (72.3%) based on theft of card credentials. Together, the two categories accounted for 88.6% of losses in 2017. (Nets.eu)

Netherlands

The Netherlands brought in a new digital ID service (iDIN) in 2016. This collaboration between Dutch banks serves to increase online security.

Dutch shoppers rely far more on debit cards than credit cards, and the country also has a popular transfer service where customers can pay online from their bank account.

Overall, levels of credit card fraud in the Netherlands are low, and have decreased substantially in recent years.

Fraud levels have reduced significantly from €33.3 million in 2013 to €12.6 million in 2018. (Betaalvereniging)

39% of card fraud losses in 2018 occurred on debit cards. This is down from 57% in 2017. (Betaalvereniging)

While debit card fraud has fallen substantially, internet banking fraud actually increased in 2018. This was usually as a result of phishing techniques including “scam emails and text messages, fake apps, fake invoices, identity fraud, and deception of financial employees of companies (known as CEO fraud).” (Betaalvereniging)

This may also be somewhat thanks to the popularity of iDEAL, the bank transfer system mentioned above. Fewer customers use credit cards in general, and bank accounts themselves may be a juicier target for fraudsters.

Regardless, the Netherlands can be considered a success story in tackling credit card fraud.

“The fact that overall card fraud losses remain significantly lower in the Netherlands than in comparable European countries suggests that its strategy of online-to-issuer authorization combined with 3D-Secure, the geo-blocking of debit cards and the use of sophisticated fraud prevention systems by domestic card processors has been effective in combating fraud.” (Nets.eu)

Denmark

As explained above, we have somewhat conflicting data about Danish rates of fraud (as a percentage of total card payment value). The European Central Bank (ECB) assigns Denmark the highest ratio of fraud to total payments. Meanwhile Nets.eu states that it has one of the lowest ratios.

Part of the cause for this may simply be that the ECB report was published in 2016, while Nets.eu published its report later.

CNP losses rose significantly from 2014-16, and “show no signs of slowing as fraudulent attacks continue to migrate across Europe, away from France and the UK.” (Nets.eu)

Denmark also has an abnormally high level of lost and stolen fraud (52.7% of total losses), perhaps due to high credit limits. (Nets.eu)

In Q2 2018, contactless card fraud made up 65% of all fraudulent card payments, despite only 56% of all payments being contactless. (Nets.eu) In other words, contactless represents a disproportionate amount of card fraud in Denmark.

“In the case of Denmark, official statistics on card fraud show that the high levels of fraud in 2016 are mostly due to the high level of cross-border e-commerce fraud, which should be viewed in the light of the large number of e-commerce transactions made in this country in combination with a high share of cross-border transactions more generally. Nevertheless, domestic fraud levels remain low in Denmark.” (European Central Bank)

Norway

Like France and Denmark, Norway has its own domestic card scheme named BankAxept. Many Norwegians also use the Vipps app for person-to-person payments. In 2004, Norway implemented the digital online identification and signature service BankID, similar to iDIN in the Netherlands.

Norwegian banks recorded NOK 145.6 million in losses from misuse of payment cards in 2017, up from NOK 126 million in 2011. (Nets.eu)

These losses primarily came from misuse of card information on the internet (70.7%) and card data stolen in Norway and used on counterfeit cards in/outside Norway (12.3%). (Nets.eu)

Sweden

Sweden does not have its own domestic card scheme. But the immediate payment service Swish is unique to Sweden.

Card fraud losses in 2017 were a low €25.9 million - about 0.02% of payments. (Nets.eu)

CNP fraud made up 48.6% of total fraud losses in 2017. Which means that rates of lost or stolen fraud (25.6%) and counterfeit fraud (21.8%) are higher than we’ve seen in countries like France and the UK.

US fraud statistics

Obviously, the United States is not part of SEPA and has its very own banking and payments system. On top of being the world’s largest economy, we’ve seen (above) that Americans have a particular affinity for paying in credit.

Perhaps as a result of this, or perhaps because the country is a large target for external hackers, credit card fraud is far more common in the US than Europe.

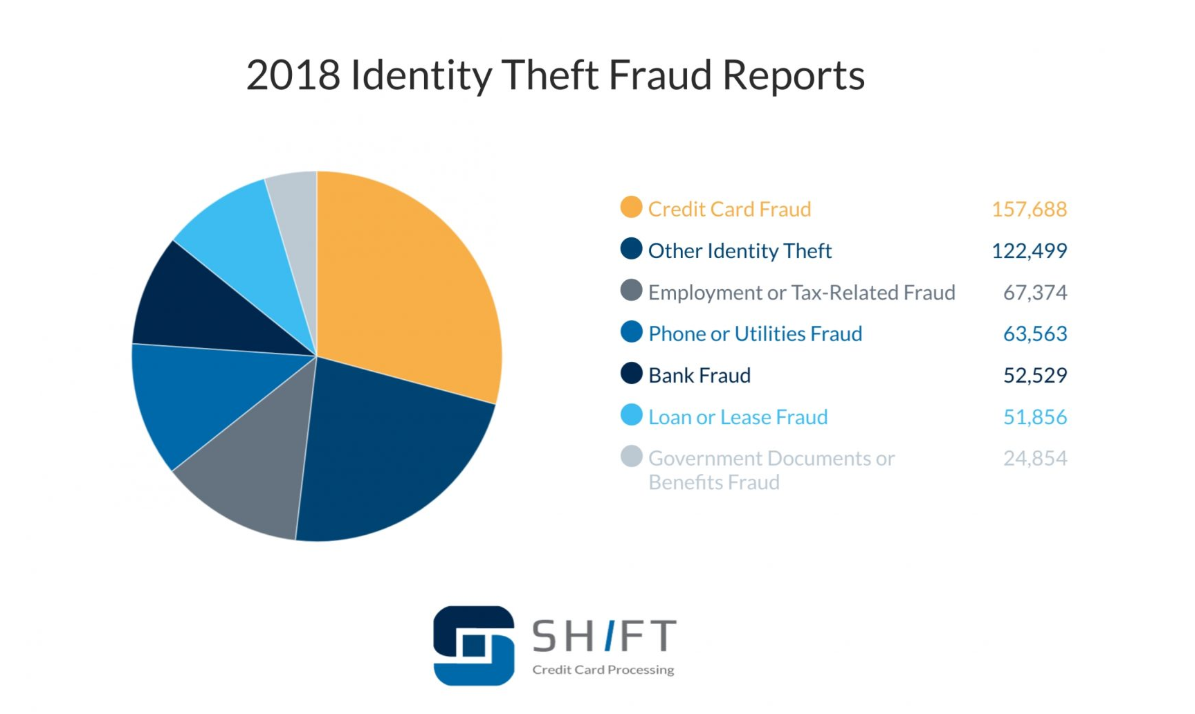

At 38.6%, the US leads the world for reported credit card fraud losses as of 2018. (Shift Processing)

Credit card fraud has been steadily increasing for the last five years. At the same time, total fraud and identity theft reports have decreased. (Fool.com)

CNP fraud is 81% more likely than point-of-sale fraud in the US. (Shift Processing)

CNP fraud hit $4.57 billion in the US in 2016, up 34% from 2015. (The Washington Post)

Credit card fraud is easily the most common form of identity theft in the US:

Georgia, Nevada and California are the three top states for identity theft (by population). (Fool.com)

It is suggested that 80% of the credit cards in circulation in the US have been compromised. (The Washington Post)

Actual losses from credit card fraud dropped from $8.1 billion in 2017 to $6.4 billion in 2018. (Forbes)

73% of Americans are very or somewhat concerned that their financial accounts, email or social profiles could be hacked. (Experian)

“Although credit card fraud is on the rise, the types of credit card fraud are changing. The United States was slower than the rest of the word to adopt EMV chip technology in its credit and debit cards, but it has been catching up. As of Oct. 1, 2015, liability for in-store counterfeit card fraud shifted to the party that hadn’t adopted EMV chip technology (merchants that don’t have chip readers and banks that don’t issue chip cards).

“During chip transactions, it’s nearly impossible to counterfeit the credit card. This means that the amount of card-present fraud -- when a criminal uses a counterfeit card to make a purchase -- is declining because criminals have fewer opportunities to create those fake cards.” (Fool.com)

How to respond to credit card fraud

If all these facts and figures have you worried about credit card fraud for your own business, we've put together an article just for you.

How to respond to company credit card fraud

Those were the credit card statistics for 2020

You've just seen the X most interesting credit card statistics available at the end of 2020.

Feel we've missed something? Let us know!

And if you need help with managing payments for your growing business, here's the guide for you:

)

)

)

)

)