In the remote-first moment we’re living in, decentralised work processes are all the rage. Executives want to know how to build teams that function independently, and don’t need constant face-time to be effective.

Of course this sounds great. Every company wants to be cutting edge and future-focused. And decentralisation just sounds cool.

But what does it actually mean? And how might it apply specifically to finance teams?

This article explores these questions, and shows you why moving towards this new workplace culture may be just what you need.

So let’s start with the obvious question.

What is a decentralised organisational structure?

Decentralised organisational structures let lower-tier team members make decisions. The opposite - a centralised organisation - involves top-down decision making.

Taken literally, think of a CEO telling every employee exactly what to do, or a CFO handling every little detail within the finance function. Conversely, decentralised organisations set their team members up for success and give them a high degree of autonomy in their work.

As we’ll see, this is as much a philosophical concept as a procedural one. Do your employees feel valued? Are they free to do what they think is best for the company?

And this decentralisation can take place on an individual basis within teams, but also across the organisation as a whole. We’re going to focus more on finance teams in this piece, but let’s first look at a good example of decentralisation taken to its logical limit.

An extreme example: manufacturing firm ITW is known as the most decentralised company in the world.

“Though ITW has $6 billion in sales, it is broken into 400 units with an average revenue of just $15 million. They make everything from welding equipment to nails to plastic six-pack rings. Each unit has its own general manager, who runs the division as if it were his own business -- so long as that unit is outperforming everyone else in the particular market.”

A highly centralised finance operation sees the CFO involved in every little task. You oversee accounting, planning, and operations. Which is perfectly normal in a small company, or if you’re brought in to build the finance function from scratch.

But as the company grows and you need to move quickly, this can quickly become a hindrance.

Centralisation vs decentralisation

Decentralisation, then, means putting more decision-making in the hands of your team members. You’ll install a Head of Accounting or Financial Controller, and let them do what they do best.

Ultimately, these are two ends of a spectrum. You’re unlikely to ever be 100% one or the other. The CFO will always have a crucial say on important financial decisions, and the final word may even rest with the CEO or board members.

But you can instil operating principles that lean more towards one end or the other. If the company culture promotes individual ownership, you can prove this by giving some decisions to non-executive staff.

Why would you want a decentralised organisation?

According to HBR, the biggest benefit of decentralisation is “responsiveness.” Decisions can be made immediately, particularly in response to opportunities or threats.

But broadly speaking, there are a few other reasons why you might want to move towards decentralisation.

It scales

When companies are small, centralisation is easy. The CFO can answer every query and make every decision relatively quickly.

But as soon as the company grows, more decisions need to be made, impacting more people. Relying only on the executive team to make decisions is no longer feasible.

Similar to building a remote-friendly workplace, decentralised processes will work no matter where people are. You can have finance team members on other continents, and they’ll still be able to work freely and efficiently using their own intuition.

It puts experts in charge

Generally speaking, frontline staff and managers tend to know the most about their particular market or subject area. And as you grow, you’ll also add specific experts in different areas of the business.

So naturally you’ll want to give these team members opportunities to make decisions from their own experience. In a finance or purchasing context, this includes letting them choose the best suppliers for goods and services, booking travel and accommodation, and allocating parts of their budgets to new and innovative projects.

As Nilly Essaides writes for Digitalist Magazine, “demand for advanced analyses and reporting is growing too rapidly for a single ‘provider’ to keep pace without creating bottlenecks in the delivery of essential insight. Business units and functions are closer to the market and know best what kinds of analyses they need to drive better performance.”

It develops employees

Part of the CFO’s role is the professional development of team members. The more responsibility and opportunity they have, the faster they’ll develop.

This obviously means their financial know-how, but also includes the softer skills they need to perform within the company. How your financial ops technicians choose and install the best tools for other teams to use, or how your FP&A experts craft budgets alongside your product and sales teams.

Letting others make decisions and lead strategies is investing in their futures. And speaking of investment...

It helps team members feel invested

You want a company full of players who truly care about the success or failure of the business. When they make decisions and create new strategies, they are inherently more invested in outcomes than if you simply tell them what to do.

Which is of course good for their own development, but is also great for the future of the company. A team that cares deeply about building a winning company is the sort of team that actually might win in the long run. You’ll keep staff around longer, and they’ll be more focused and motivated the whole way.

It takes administrative pressure off leaders

Ultimately, executives are responsible for what becomes of the company. And we’ve all met high-functioning micro-managers who somehow seem to know every little thing happening.

But CFOs don’t have to be personally responsible for every small financial choice along the way. Delegate, and focus on your most important tasks. Even better, hire talented people who add abilities to your teams, and let them play to their strengths.

You’ll be better prepared for emergencies

What if something goes wrong and the CFO isn’t around to fix it? If your team is used to making smart decisions on-the-go, they’ll be ready to do so in a crisis.

As we said above, “responsiveness” is one of the best qualities of decentralised teams. When employees know that they’re trusted to make on-the-fly resolutions - and they’ve practiced making them in the past - you have a better shot of reacting well to crisis situations and emerging in the strongest possible position.

How to create a decentralised finance team structure

In essence, decentralising is as simple as choosing to do so. The CFO can simply tell their team members “you make the decisions now.”

But of course, impactful and lasting change isn’t made this way. You’re trying to a new working culture and processes to match.

So how can you do this in a structured way that gives it the best chances of success?

1. Make it a key company (or team) value

Hopefully, your company will already have core values and operating principles set out shared and observed by the whole team. If you want decentralisation to be at the heart of your business, it (or something like it) needs to be enshrined as a value.

For example, one of our six core values at Spendesk is that we’re all owners of the company and its future.

We each own our own scope, each team owns its KPIs and budget, and the vast majority of decisions are made by operational teams - not by executive leadership.

Even if the company’s values are set in stone, you can still create core principles within the finance team. And you can practice decentralisation from the outset by involving the whole team in the process.

Buffer wrote a great guide on inclusively creating company values. It’s full of simple, useful tips and steps to take - nothing fancy and no magic bullets.

You can do this exact same exercise with just your finance team.

2. Establish cross-functional teams

There are two obvious reasons why other teams constantly come to finance for help:

They don’t have financial expertise in their own unit(s)

Finance is there to act as a check and balance to validate decisions

Which makes sense, but isn’t always an efficient way to operate.

Instead, why not strategically place financial knowledge inside these other units? The easiest way to start doing this is on a project-by-project basis.

When another business team has a project that implicates finance in some way (a large budget, or lots of purchasing and inventory involved), include a finance team member from the start to help steer the ship.

You can also do this on a longer-term, more flexible basis. For example, meal delivery service MarleySpoon has its FP&A team constantly working with menu planners. This ensures that they’re using the food budget wisely, and helps chefs understand better the financial imperatives behind their meals.

At the very least, you can use cross-functional teams within finance to put employees in new positions and encourage knowledge sharing.

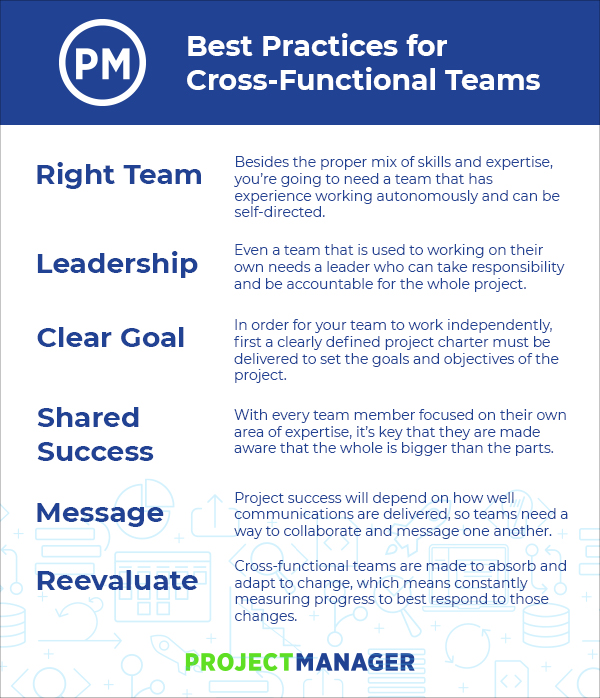

What are the best practices for setting up these teams? Project Manager has a nice (short) guide, including the following best practices:

3. Practice healthy communication

Clear communication is a theme that comes up again and again in business. Everyone probably thinks they’re a good communicator, yet somehow there’s always room for improvement within teams.

Team members need to know how to work with one another effectively, including delegating work amongst themselves. Emphasise clear, direct communication, and help employees who need it.

One important aspect of good team communication is having clearly defined roles, according to Ninety:

"When we communicate roles to the entire team, we nurture mutual respect. When responsibilities are distributed equally among the team, people can see the importance of their actions to the overall success of the team and the organization."

In this way, decentralisation can itself also improve communication. By leaving decisions in the hands of the best people for each job, you also share the onus to communicate across the team.

But good communication won’t happen overnight, and it’s the CFO’s responsibility to emphasise and encourage it to be done well.

4. Develop individual skills

CFOs - like any other manager - need to ensure that their teams learn new skills and progress in their careers. As we’ve already discussed, decentralisation will help team members develop professionally by putting more responsibility in their hands.

But you can’t just throw them off the boat and hope they’ll swim to shore. As the finance team leader, you have to provide training in smarter decision making, at the very least.

If you’re installing cross-functional teams, finance professionals may also need to gain knowledge in other business areas like sales or marketing to contribute fully.

Outside your own team, you’ll also be able to train the wider company on financial principles. Eventually, you may be able decentralise many tasks outside the finance team altogether. A small example: what if team managers ensured that all purchases had corresponding receipts before they were sent to finance?

As a general rule, decentralised organisations breed smart employees. And you can keep everyone engaged and motivated by gradually increasing their scope and knowledge level over time.

5. Give employees the tools they need

On top of adding knowledge, employees need the right systems and tools to make great decisions.

Some of these are fairly obvious. For example, you should have modern communication tools to let information flow freely between yourself and your teams.

One effective modern communication tool is a cloud phone system, allowing for seamless collaboration and communication. This is especially valuable for decentralised teams. Other tools for remote teams have suddenly become enormously popular (and necessary), and these also work wonders for decentralised teams.

But on top of clear communication, you can seek to decentralise certain tasks - to give more autonomy to employees all over the company. A great example of this is making the expense process more user-friendly, which then removes many of the worst hassles for your finance teams.

Give your frontline teams expense automation tools, and they go from an unregulated, paper-based claims process to a fast, enjoyable, and trackable way to pay and get reimbursed. And your finance team moves from being police to actually empowering these other teams to do their best work.

As well as tangible tools like software and apps, you’ll also want to install smart frameworks to test hypotheses and make decisions. These might include now-popular working methods like Scrum or Agile. [Read more about Agile methodology at Kanbanize.com]

You’re going to ask more of your team members, so give them the tools they need to deliver.

6. Offer support and establish mentors

In theory, once the day-to-day decisions are off your plate you should have some extra time on your hands. Of course, it never really works that way.

But in the early days of your new structure, use some of this “extra time” to provide added support for team members exercising new responsibilities. That doesn’t mean making the decisions for them - that’s going back to the status quo. But invest time with employees to set up their processes correctly, and make sure they know they can come to you when necessary.

Another great move is to help your team find mentors they can talk to when not talking to you. You may not be the best person to support every single team member. Instead, look around (inside or outside the organisation) for mentors for people in key roles.

Good mentors will be people who’ve gone through the same journey that they’re experiencing, and can offer advice.

Delegate responsibilities outside the finance team

We’ve touched on this above, but decentralisation shouldn’t be limited to just your finance team. You can also decentralise roles to others in the wider company.

Here are a few quick examples:

Spending approvals - Managers should be ultimately responsible for what their teams spend. Let the finance team focus on the company’s overall financial health.

Budget management - Help managers set their budgets, and then get out of their way.

Purchasing - Not every transaction has to run through the finance team, purchasing department, or office manager. Your teams know what they need and often the best suppliers, too.

Payment methods - To make purchasing more efficient, gives teams their own ways to pay for what they need. In the past, that might have meant company credit cards or expense reports. But today, corporate expense cards give teams the freedom to move quickly, while keeping finance in control.

Again, if the company culture is individual (and team) ownership, that can include some key processes that previously belonged to finance. Let others worry about the nitty gritty, and you can focus on being the best business partner possible.

Conclusion

As we’ve seen, decentralisation isn’t some hard and fast delineation. You don’t go from one day being a centralised company to the opposite overnight. You’re far more likely to move gradually along the spectrum, updating processes as you go and systematically making small adjustments.

But decentralisation is a worthwhile goal for most companies. It makes you more efficient, and frankly more modern. This is the way workplaces are going, and you probably want to keep up.

At its core, this involves:

Setting out delegation and ownership as a core company value

Improving internal communication to let knowledge flow freely

Removing slow, clunky processes that hinder efficiency

Putting many tasks into the hands of frontline teams, and removing them from finance

For more information on building a healthy company culture - particularly around spending - grab our free guide:

Curious how Spendesk works?

Try an interactive demo to see spend control and approvals end-to-end.

Get a free tour

)

)

)

)

)