Ask any CFO or financial leader for their number one priority at work, and you’re almost guaranteed the same response: “cash is king.”

Before building exciting financial models and forecasting the future, you need to know how money comes in, and also how it goes out. And it’s that second part that trips up a lot of finance teams.

This article explores what it means to control spending. In particular, we’ll see how many of the most common company spend processes actually lead to less control for finance teams - even if they don’t know it.

We’ll also show you the keys to effective spend control, and some of the reasons why it’s so vital to have.

So let’s start with a nice definition.

What is spend control?

Put simply, spend control describes the level of management and monitoring a business has over its outgoings.

The better finance teams can control company spending, the better they can protect valuable cash and create more informed financial forecasts.

Important note: spend control doesn’t have to mean cutting costs. In fact, strategic spending is essential to company growth. And your budgets are there for a reason.

Rather, control simply ensures that you know what you’re spending, that every purchase is approved, and that you’re able to stick to those budgets you’ve set.

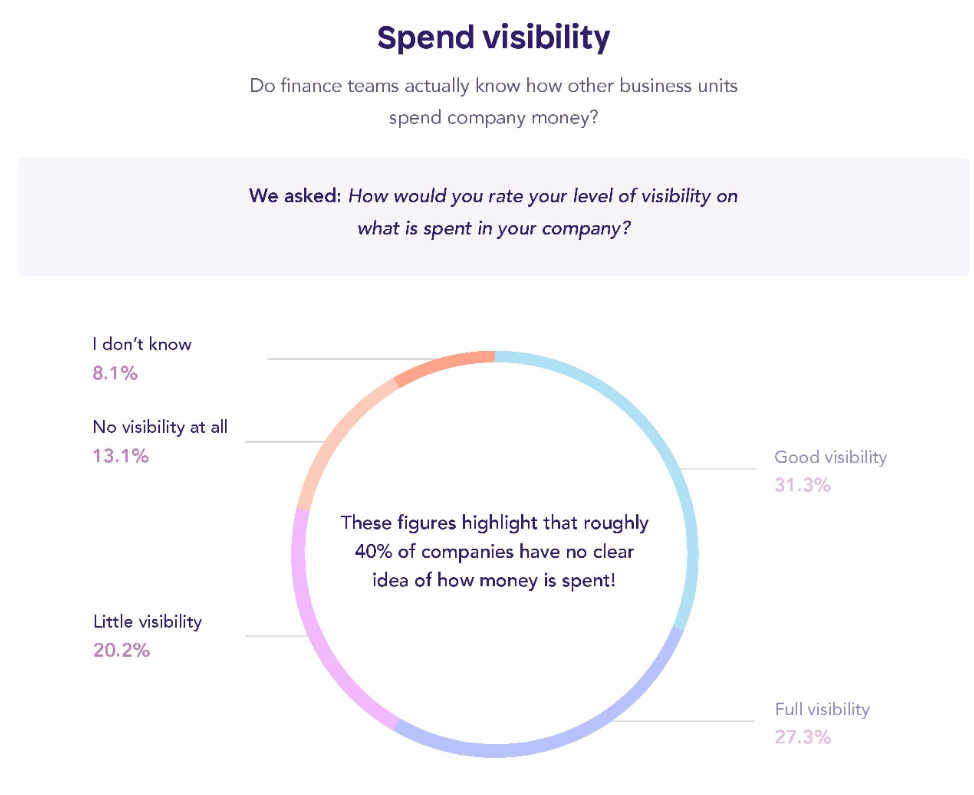

To achieve great spend control, finance teams need visibility. Visibility over where money goes, and who’s spending it. And that’s something that a huge proportion of companies don’t currently feel they have:

Source: State of Spend Management survey by Spendesk and YouGov

Spend control vs cost control

In contrast with our note above, "cost controls" almost always refer to reducing spend. Spend control doesn't have to.

But they two terms have plenty in common, and we'll talk about "costs" and "spending" somewhat interchangeably in this piece.

For our purposes, we’re mostly talking about discretionary spending. Of course, payroll, rent, and utilities are costs and need to be managed. But these are typically pretty consistent, and businesses have a good grip on their operating expenditure in general.

So as we explore spend control, we’ll talk more about those variable costs that companies always struggle to pin down.

Spend affects a range of processes

In fact, let’s look at some of those costs right now. We’re passionate about the idea that companies (and employees) need to spend to do their best work.

As mentioned above, companies spend across the board; it’s expensive to run a company! But there are several key processes where proper control is often missing:

Procurement and supplier relations - especially in companies with informal processes and no purchasing department.

Ad hoc expenses - most companies rely on honesty and common sense from their teams, and don’t have a good way to monitor what’s being spent.

Subscriptions and online payments - with budgets for SaaS tools going up fast, finance and budget managers struggle to monitor every payment going out.

Business travel - in prosperous times, companies spend large sums sending team members to visit clients, attend conferences, and move between offices.

Not to mention bookkeeping and tax filings, which can take weeks if you don’t have a clear idea of who made which purchases.

And while some companies have financial controllers in place to oversee this, line managers and other non-financial staff play a crucial role.

Do companies really need to control spending?

Yes.

As we saw in the introduction to this piece, a large percentage of businesses have no real idea how company money is spent. Which is a challenge during good times, and a real nightmare when cash flow becomes a problem.

According to CFO Connect, cash flow management was identified as the single biggest issue for companies during the Covid-19 crisis.

After a decade of economic growth, companies suddenly had to manage every dollar, euro, and pound they spent. Which is truly difficult when you aren’t fully in control of the money going out the door.

And this is still a major issue. One key job of the finance team - especially the financial controller - is to record and report on cash in and cash out. So your ability to control both is imperative.

5 consequences of out-of-control spend

So what’s the upshot for those companies struggling to stay on top of spending? Here are just five of the ways it can have a real impact.

1. Poor financial planning

Budgets and forecasts are serious business for CFOs and FP&A teams. And they rely on good data to build them.

But it’s very hard to prepare and enforce budgets if you don’t have a firm grip on where company cash is going. Your budget for next quarter will almost certainly reflect spending over the past few. And if you can’t accurately report on this, your budgeting will take a real hit.

Which then has more serious impacts once budgets go live:

You may underestimate what individual teams need, which holds them back and slows company growth.

If the budgets aren’t enough, teams may just spend over them. And without good spend controls, you likely won’t catch this in time.

If budgets are too high, teams may spend frivolously, and then be shocked when they don’t have the same opportunities in future.

In general, you should aim to create sound budgets based on real spend data. Otherwise, everyone’s just guessing.

2. Unnecessary and time-consuming admin

Ask any finance team for their most stressful work periods, and they’ll undoubtedly say it’s the close process. They have to scrounge and beg to get all of the information they need simply to record how much money came in and went out of the company that month, quarter, or year.

The concept is actually quite simple. But what makes it so gruelling is the incomplete data they deal with. This includes expenses without receipts, spending that’s not linked to a team or budget, and missing approvals from managers.

A lack of control usually leaves it up to finance teams (namely the financial controller) to fill in the gaps. They end up having to chase employees all over the business just to get to the bottom of payments.

And for their part, non-finance teams know the familiar dance of processing employee expense reports. These just create extra paperwork for frontline staff, and don’t offer any real control to their managers and the finance team.

Expense admin is still out there, killing productivity in businesses worldwide. Keep reading for solutions to this issue.

3. High error rate

While we’re on the topic of paperwork, manual processes like expense reports are a breeding ground for human error. And usually for one simple reason: nobody wants to deal with them, so they’re hardly going to give it their best.

Which has a natural flow-on effect. Your already-swamped finance team has to go through each claim to check for errors (which they will certainly find), and then take the time to remedy them with the staff responsible.

Or maybe they don’t catch the error, which can lead to serious issues at tax time.

As we’ll see, proper spend controls actually remove most of the manual work. Which naturally makes processes faster, but also free from issues like these.

When key spend processes aren’t streamlined (and automated), the number of human errors goes way up. Conversely, expense automation nips most of these issues in the bud.

4. Serious fraud risks

Most businesses probably aren’t aware of the risks that come with their classic spending habits. But if they’re sticking to expense reports and credit cards - both low-control options, by the way - they’re certainly taking a chance.

An alarming number of employees admit to falsifying part or all of expense reports - as high as 10%. And one study from the US found that some employees steal as much as $25,000 per year through expense fraud.

Many of these cases won’t be intentional - or at least not malicious. Perhaps the employee simply forgot what was spent and gave a rough guess. But even if there’s no harmful intent, this is dangerous for the company.

Credit cards are another case in point. When the card ends up all over the web, the chances of credit card fraud go way up. Credit fraud is a multi-billion dollar industry in both the US and UK. And yet lots of companies carry on using their cards as if nothing could possibly go wrong.

5. Less long-term stability

In the end, good spend control really equals strong finance processes and sound practices. To keep the business in business for the long haul, you need to know that spending is under control.

With spend controls in place, you’ll be unable to manage the cash runway effectively, and optimize cash flow. And you’ll be ready for any significant audit that comes along.

And as we’ll see, achieving control isn’t particularly difficult, expensive, or time consuming. Most companies simply don’t know their options.

6 keys to controlling company spending

Hopefully it’s abundantly clear that good spend control is essential for any business. So how can you achieve it?

When you’re looking for software, solutions, and new processes, here are six essential elements.

1. Suitable payment methods

We’ve seen several times already the problems that come with relying on expense reports and company credit cards. These are old fashioned tools that simply can’t keep up in the modern world.

And the simple remedy is to give every employee access to safe, efficient, and controlled spending methods.

These should include:

Physical expense cards with customizable limits specific to each employee. These mean they won’t have to pay with their own money while out in the field, and thus won’t have to submit expense reports.

Virtual credit cards to pay online. These show your finance team all ongoing payments (subscriptions) at any point in time, and prevent you from using the same company card online.

Expense and invoice automation. These let employees submit invoices and file (rare) out-of-pocket expenses through a platform, rather than on paper. They enter the data once, and it’s there to see for managers and finance teams instantly.

Your current payment methods aren’t really designed for companies - they’re just workarounds. So look for options that were specifically built for businesses!

2. Real-time visibility over spending

Whatever payment and reporting options you choose must ensure that you can track spending in real time. How can you control spending if you don’t know what’s been spent until it’s too late?

In simple terms, this means you need a central platform or dashboard. Your finance team and managers should be able to log in and see every payment, past and scheduled.

Today, you might rely on your accounting ledger to track all of this. But it won’t be updated until the credit card bill arrives and employee expense claims come in.

But real control requires all this data the moment that payments are created.

3. Easy receipt collection

We saw above just how painful the closing process can be for finance teams. And the biggest culprit in this is missing receipts. Without receipts, expenses can’t be validated. And the company has to eat the cost or employees don’t get paid back - which isn’t really fair either.

As part of your new spend management solution (with payment methods to match), you want a simple way for employees to digitize receipts the moment they receive them. That is, before they get lost.

This usually means an easy-to-use mobile app. They just snap a photo of the receipt, and the app matches it to the payment on their expense card. (Even better if the app prompts them to do this, so they can’t forget).

The goal is to make this process foolproof. A little smart planning eliminates countless wasted hours for finance teams every month.

4. Built-in spend policies

A great travel and expense policy is one of your best tools to help maintain control over costs. Your policy should set out the kinds of spending permitted for your employees, and how they should go about doing it.

But writing the policy is only half of the battle. Because an administrative work of art is essentially worthless if your team members don’t follow it.

And here’s a stat that should concern you: two-thirds of employees haven’t read their company expense policy. So perhaps relying on the written word isn’t going to cut it.

Your best bet is to build rules and restrictions into the payment methods your employees rely on. For example, if your sales team use expense cards that keep them within a limit, or prevent them purchasing alcohol (for example), they have no choice but to follow these rules.

You can do the same with virtual cards for online spending, and even set global limits that apply across payment methods. So your Head of Marketing may have $10,000 per month to spend on advertising, travel, and tools, and when they hit that limit (online, through invoices, or with a physical card), they’ll have to formally request more.

Clear policies are key to keeping spend in check. But the best ones don’t require employees to memorize rules - they build the policy into the payment methods themselves.

Get the playbook to write a great company expense policy here.

To truly control spending, managers and finance teams will need to be able to approve or deny costs in advance. They’re the ones who should be monitoring budgets, and they need to make sure that every cent is spent responsibly.

5. Easy ability to approve spending in advance

But doing this manually for every little expense could bring the company to a screeching halt.

Here’s a quick look at how companies manage expense approvals today:

Source: State of Spend Management survey by Spendesk and YouGov

We see a wide range of options. But only 10% of businesses have an automated approvals system. Which is far too low!

Today, you can actually set parameters to pre-approve company spending. So as long as employees meet certain criteria, they don’t have to ask for permission every single time.

This can be managed and recorded in a dedicated app or platform. And then anything that falls outside these parameters can receive manual approval - also through the same app or platform.

A further 16% of businesses use this method. Managers receive notifications and can approve spending from anywhere. No need for an email trail or in-person conversation.

And the less you rely on in-person conversations to manage spending, the healthier your spend processes.

6. Clear measures to combat fraud

Two statistics that should make you at least a little nervous:

85% of employees admit to lying on expense reports (AKA: fraud)

Credit card fraud is easily the most common form of financial fraud in the United States

So businesses that rely on expense reports and company cards - the vast majority of businesses - are consistently exposed to fraud risks. And most of the risk comes from the fact that these payment methods are so hard to track.

Proper spend control should let you spot unusual spending by highlighting unexpected rises, unapproved suppliers or spenders, and incomplete transaction information. But expense reports and company cards fall short because you usually don’t know what’s spent until weeks later.

And in the case of expense reports, you have a receipt, but you don’t have access to the employee’s bank account. So you can never really know where the money went.

A good spend management solution will instead log every transaction the moment it’s made, and give finance teams up-to-date data. Most importantly, you’ll be able to see any unexpected spikes in spending, unusual suppliers, and money spent in suspicious circumstances.

Basically, you’ll have more visibility. Which means less fraud, and more control.

Take full control of company spending

As we’ve just seen, control is usually a result of visibility over where and how company money is spent. If you can confidently say that you know in real time who’s spending, why, and how much, then you’re probably in good financial control.

But too many businesses rely on outdated payment methods that give them almost no visibility. They wait until the end of the month and then try to piece things back together.

This is how it’s often done, but not how it should be done today.

To help understand what makes for a healthy and controlled company spend culture, read our free guide:

Curious how Spendesk works?

Try an interactive demo to see spend control and approvals end-to-end.

Get a free tour)

)

)

)

)

)

)