In my work as an executive coach and investor, I see financial plans from all sorts of companies. There’s a classic playbook that most CFOs work from, and it certainly serves a purpose.

But in my view, most financial plans lack imagination. They show the company we can expect to see, but not the one we’d actually want to build.

And as someone working closely with startup executives, it’s the passion and vision that get me excited.

So in this article, I’m presenting a new way to craft startup financial plans. It shows you how to:

Picture the status quo, and identify your company’s strengths and pain points

Envision your company in the future, with key markers for success

Work backwards from that goal to systematically upgrade your business systems.

I built this model with help from Jana Scharfschwerdt and Leander Kouparanis. This is how we advise our clients to plan for financial success.

First, let’s look at why traditional financial plans don’t tell the right story.

The problem with startup financial planning

One of the fundamental problems of planning in the early stage is the uncertainty around your assumptions. Founders need to make assumptions about their unit economics and other financial metrics, and what they might look like in the next three to five years.

From an investor perspective, I can totally understand why you're doing that - you want to look rock solid in your numbers. But those are usually just assumptions.

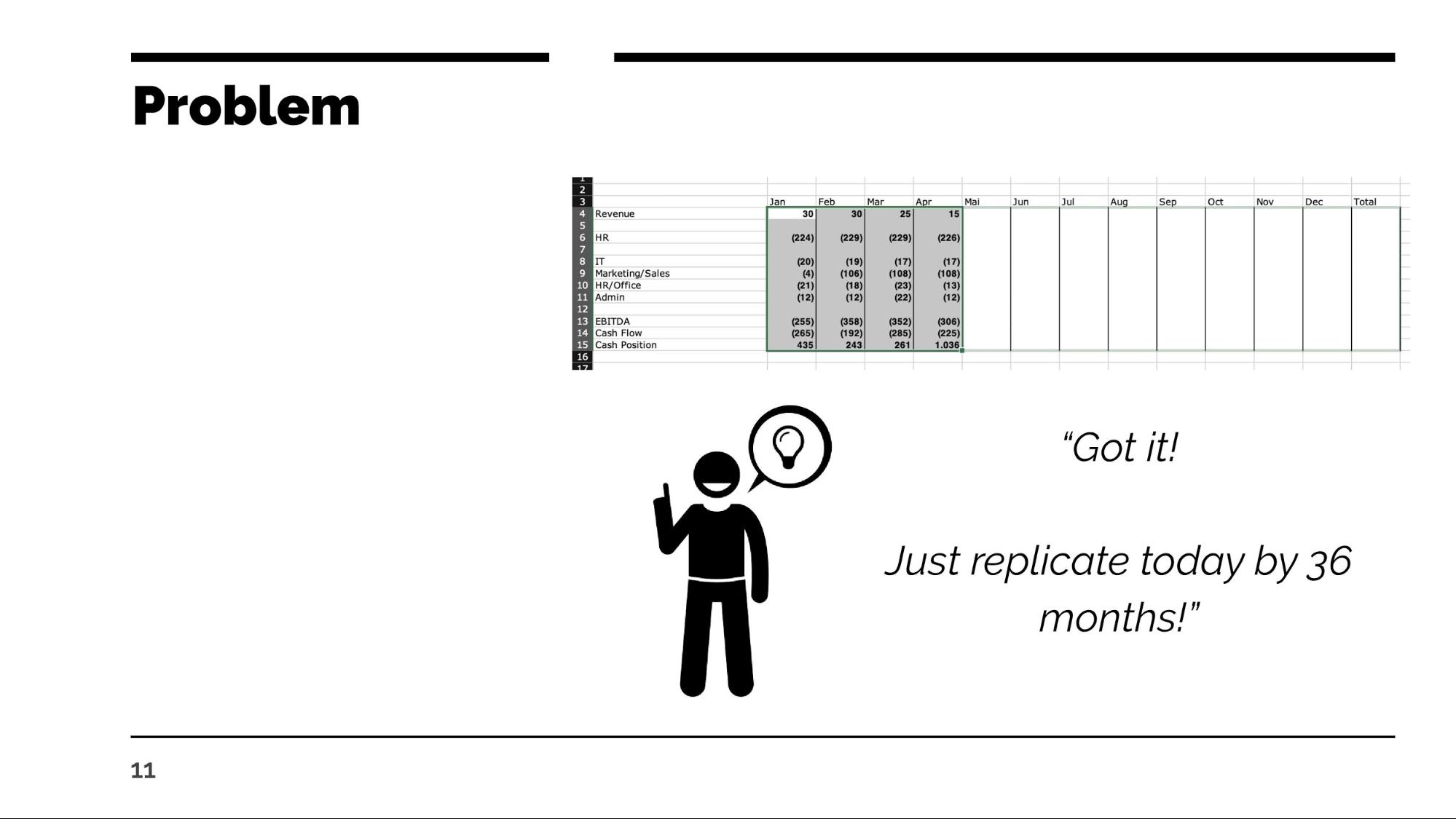

So you take your actual numbers for the last couple of months. You see how they relate to each other and then you think, "so how am I going to project this into 2024 or whatever is asked by my investor?"

We all know this great function, where you basically take the column and you just pull it out 36 times. And that's a great idea in theory, because then your financial plan looks complete for the next three years.

But the problem is, this replicates today’s thinking (based on the last few months) into the future, and it doesn't stimulate a discussion about how you would reach your goals. It’s just relying on your current growth rate.

A vision of the future

In executive coaching, one of the ways I work with my clients - mostly founders and some investors - is I have them envision a desirable future. Don’t think in terms of what they’re already doing today, but imagine they're already in the future. And then I have them re-engineer how they got there.

Which of course is easier said than done. So in this article, I’ll explain how you can do that for your own business. And I’ll do that with the help of a particular analogy.

Flight planning

When you fly an airplane, you never start flying without actually knowing your closest potential airport in case of emergencies. When you’re flying from Berlin, Paris, or London, you might have hundreds of potential sites to choose from.

But when you fly across the Atlantic, you actually have to fly north to find a landing spot. [That’s why so many planes fly over Iceland, incidentally.] And your ability to glide to your next possible landing spot becomes even more important.

Pilots know that, if anything happens at each specific point over the Atlantic, they have a precise turn to make to take them to safety. And we can use this same analogy in financial planning.

A good financial plan includes the following five steps.

1. Know your plane

To make any kind of financial plan, you need to understand your business intimately. Pilots spend months in flight school before the first take-off - they make sure they know how every engine, lift, and flap works. And they look closely for warning signs whenever they set off on a new journey.

You should do the same analysis of your company before embarking on a financial plan.

There are also specific leverage points in any business that founders or CFOs can push and pull on to different effects. You need to know where in your business these levers are, and how your system would react when you pull on them: some of these interventions may have outsized effects.

You need to look at the whole business (the plane), and find those strengths and weaknesses before take-off. In times of crisis, these are often the best places to begin recovery, because small changes can have major impact.

In the current climate

Go through your supplier and customer lists. Understand where your revenue comes from, and the other businesses in your ecosystem. If you see lots of travel- or hospitality-related companies right now, they’ll clearly have a direct impact on your own business.

But also look at your processes, and find those pressure points that either slow down business or are helping you grow. These probably include particular bottlenecks you have around paying suppliers or getting paid by customers. They might also be some sales processes that need to be updated, or unusually high churn numbers in specific verticals.

Likewise, they could be your biggest strengths. Perhaps your NPS score is very high, and comes with a low churn rate to match. This suggests that your plane is a great glider, and you can maintain close to current revenue levels even in rough weather.

In the next step, we’ll use this analysis to figure out your current outlook.

2. Know your airspeed, altitude, and bearings

This is the analysis I described above that most companies use in their financial planning. Based on what you know about your business today - your current cash burn rate, revenue from customers, and level of investment - when can you expect to be profitable? Or in the case of a lot of startup finances, when will you run out of money?

Even if this analysis isn’t enough, in my view, it’s undoubtedly important. In the next few steps, we’re going to go further, and this is where the real innovation occurs.

But you do need to understand the status quo - to see where you would land if things continue as they are. This lets you push further and build a company that beats these expectations.

In the current climate

Obviously, the COVID-19 crisis is a perfect example of why we can’t just multiple extend January’s results for 36 months. But using your best assumptions about the future of this virus, create your forecast for the coming 12 months, at least.

And in my view, it’s worth creating a clear picture of the worst case scenario. My personal expectation right now is that we'll have multiple lockdown periods. We may have a second or third wave of this, and the measures will be equally drastic.

Perhaps we’ll be better prepared, but it will still be tough on businesses. Particularly if you’re relying on specific suppliers, or you’re in a hard-hit industry.

Frankly, this exercise paints a fairly dark picture - unless you’re one of those few companies that’s only slightly affected. But we’re only at step 2. And this is where it gets interesting.

3. Determine your landing site

The previous step will have shown you your expected trajectory based on current projections. But this one invites you to envision the one you want to make it to in three years’ time.

What will the company look like overall? What will your new metrics be, and how do they compare to the ones you uncovered in step 1?

And this doesn’t have to be a three-year exercise - although it works beautifully for this traditional startup forecasting. But in times of crisis, you can do the exact same thing with more urgency. The purpose of this exercise is to get you thinking outside of the box - the one you’re caught in when you model your business based on today’s assumptions.

Where circumstances have drastically changed, one of the best things you can do is to plan backwards - from cash flow “upwards” to P&L, to sales leads. Where is my operating cash flow? And then go from cash flow to margins, contribution margins, and then on up into revenue planning.

And then for that same reason, you also move up the funnel. For that level of revenue I need to produce, how many sales leads do I need? How many marketing leads do I need? Please do take into account unit economic profitability when you go through this exercise.

So we can translate all of this back into our flight analogy. You need to know what your emergency landing strip looks like - your minimum viable operating model. What it looks like in terms of the financial metrics at every stage of the funnel, and how your business can actually operate in this scenario.

In the current climate

Right now, your desired landing point involves flying out of a very rough storm - one that will eat up most of 2020 and will likely bleed into the years to follow, too. So how do you want to see your company on the other side?

In the current climate, the main goal for your company may be to simply have cash flow break even. You realize that outside financing is unrealistic at the moment, and you need to stay afloat (or airborne).

What are the elements needed to have a functional company? And what is the cash-in level you need every month in order to sustain the business with those costs? Importantly, you are not asking “how much can I save?” but “what elements make this scenario viable?” From these elements, you work backwards through your business plan and funnel. You determine the associated metrics you will need to reach.

This would be your new emergency landing spot.

4. Calculate your new flightpath

As a result of the previous step, you now need a new flightpath. That means new airspeed, new altitude, and new bearings.

In sunny skies, you would do this for a three-year timeframe. You’ve identified the new landing point you want to reach - perhaps it’s profitability, or an IPO. So now you need to choose the specific drivers that will help you get to that point, and the points in time at which you’ll tackle each one.

This is so much more practical and realistic than simply copy/pasting your current numbers 36 times. And it will include a huge number of actions that will still make sense, crisis or no crisis.

But as we saw in the previous step, you may also need to fly your plane to an emergency landing strip in the coming months. Here’s what that would look like.

In the current climate

You’re still trying to make cash flow break even - as mentioned in the previous step. So you need to reverse-engineer cash flow for the months ahead. Suppose you need to generate €100,000 per month to keep the company going. And you have a small buffer now, but in five months that will have evaporated.

What actions can you take today that will help to generate €100,000 per month in five months’ time?

Specific items might include:

Speeding up your invoice to cash cycle - possibly even automating it altogether

Addressing opportunity conversion rates and helping sales teams close faster

Identifying pipeline revenue that could be brought forward with discounts or special offers

Looking for upsell opportunities with existing clients

Anything you can do now to speed up lead times in the near future will be valuable. And of course, new payment or invoicing processes should help to get cash into your accounts on time.

5. Take action

This is obviously directly connected to the previous step. That was the planning, and this is the action.

But don’t just rush into it. Good planning beforehand is essential. Otherwise you may need an airport in the middle of the Atlantic, and you won’t know where to find one.

So plan first, and then go into execution. You don’t want to realize at the end that you’ve let important people go that could help now. Think the whole way through - don’t just cut costs and then see if that works.

Make the plan and work backwards.

Act decisively and start small

Rather than relying on linear or exponential functions to “predict” your - the old-fashioned method - the goal is to take small actions related to the pressure points you’ve identified.

As a founder or startup CFO, imagine how the company will look in 18 months - specifically along the 3-5 core metrics you've set for your business. And don’t immediately assume this requires a constant growth rate to get there. That's not reality.

You’ll still be thinking about the future from a sound financial standpoint. But you'll actually have very practical steps to take, and the power to make a real impact.

And that’s so helpful as you reach each milestone. You've imagined it, trained for it, and you have initiatives in place. You've thought about the safety net, but also you have some practical ways to get you back to profitability when things get tough.

You can do this scenario planning for multiple scenarios. You can use the same process for 22 months, 36 months, or however long you need.

And just as pilots have their safety checklists, you need a few KPIs to monitor along the way. Ideally, only three KPIs at a time. Five, maximum. This way it’s usable and digestible for the entire team.

You should be able to recite them all by heart. Refer back to them constantly in meetings, and make sure that everyone has the same goals in sight.

Financial planning in a crisis

If there’s one thing you can take away from this article, make it a habit to think about how you want your life and your business to look when the tough times are over. Start your day and your week with that in mind.

This can have a profound effect on your business planning, but it’s also a healthy and encouraging way to approach life in general.

And I think we all need a lot of encouragement right now because we're all sitting at home, looking at empty streets. I wish you all the best of luck.

Get it touch with Julius and Jana at www.financial-resilience.com

Curious how Spendesk works?

Try an interactive demo to see spend control and approvals end-to-end.

Get a free tour

)

)

)

)

)